Korean Pop: SM Entertainment's Production-Line Approach to Success

Lee Soo-Man built his SM Entertainment into a music powerhouse. Swept along by the Korean Wave, it’s conquered much of Asia

For a look inside SM Enter- tainment’s K-pop marketing machine, stop by the Lotte Young Plaza department store in central Seoul this summer. For two months, South Korea’s top record label and music talent agency is branding the six-storey building with a giant banner of its latest act, EXO, a boy band. SM has taken over the basement with a pop-up store selling everything from bags, clothing, folders and postcards to collector’s edition CDs of Girls’ Generation, Super Junior and the company’s other groups.

The company kicked off the K-pop phenomenon in the 1990s. With its boot-camp-style training for the performers and production-line approach to the music, it perfected the model for churning out acts that storm Top 40 charts and pack concert halls across Asia and beyond. An SM report lays out the industrial scale of the enterprise. For spots in its groups, it receives 300,000 applicants in nine countries every year. Its training facility in Gangnam is 2,550 square metres. It collaborates with 400 songwriters worldwide and samples some 12,000 songs a year. From 2010 through last year, its artists played to a total audience of 2.5 million. Its YouTube page gets 1,000 views a second. One key to its success: It was the first Korean label to market “bands as brands”, says Bernie Cho, an ex-MTV executive and now president of Seoul entertainment agency DFSB Kollective.

The SM model is immensely profitable. Last year, net income almost doubled to $38 million on an 82 percent jump in revenue to $225 million. The company, which went public in 2000, now boasts a market capitalisation of $660 million—much bigger than its closest rival, YG Entertainment, the label of global superstar Psy. All this, for the second year in a row, puts SM on Forbes Asia’s list of the best 200 listed companies in the Asia-Pacific region with an annual revenue of under $1 billion.

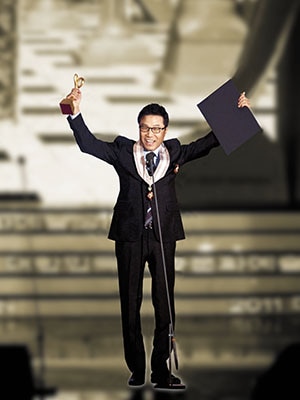

Image: Getty Images

Girls Generation

The man behind SM Entertain- ment is 61-year-old Lee Soo-Man. He was a moderately successful folk and rock singer, and later a deejay, but his real talent proved to be business. While studying computer engineering at California State University in the early 1980s, he had a front-row seat for the music revolution launched by MTV, which was forcing bands to be visual as well as musical. In 1995, he started SM and, from the start, he saw it as an outfit that would build acts rather than simply sign them. He stepped down from the board in 2010 but remains the largest shareholder, owning a 21.3 percent stake that’s worth $160 million. Citing their busy schedules, Lee and the top executives declined to be interviewed for this story.

The first K-pop group to roll out of the SM factory was the boy band HOT in 1996. It popularised an upbeat, catchy style of dance music that had been coming into vogue. More superstars followed.

The process that produces these bands is formidable. “My day would start at 7 am,” recalls Brian Joo, 32, a Korean-American who was one-half of SM’s rhythm & blues duo Fly to the Sky, now in hiatus. “We did dance with two different choreographers, vocal training, how to speak to the camera, how to approach people.” Any faults meant extra work: Joo, who was “a little chubby”, had to stay late for extra dance sessions.

Like South Korea’s manufactur- ing conglomerates, Lee realised that profits beckoned abroad. As the hallyu, or Korean Wave, of pop culture washed across Asia, SM jumped in, becoming the first Korean label to join with overseas players, notably Japan’s Avex Group. Mark Russell, author of Pop Goes Korea, says that was key to breaking into a music market 20 times as big as South Korea’s. Today, SM maintains overseas offices in Japan, China, Hong Kong, Thailand and the US.

Seven years ago, South Korea became the first country where digital music sales surpassed physical sales. But booming digital sales hammered pricing as online music outlets aggressively slashed prices to kill piracy. So with music-sales earnings evaporating, SM began deploying its artists more widely. Helped by their squeaky clean images, the K-pop singers signed on for product placements, TV appearances, roles in musicals and endorsement deals. Concert revenues and merchandising became a bigger part of the business.

The past year has been bumpy for SM. The stock is down 23 percent in 12 months, and this year’s first-quarter profits dropped 30 percent from the year-earlier quarter. Kim Shi-Woo, who covers SM for Korea Investment & Securities, blames the weaker yen and a lack of major SM events in Japan—K-pop’s biggest overseas market. He says more events are planned for the rest of the year. Indeed, analysts expect net income for 2013 to rise 22 percent over last year, to $40.2 million. Revenue is seen increasing 11 percent, to $166 million. Samsung Securities sees SM rolling out a strong line-up of new acts, while new TV and telecom services will provide new sales channels.

Yet the manufactured quality of SM-style K-pop irks some. “The artistic side is what is lacking right now,” says Hahn Dae-Soo, a folk and rock singer sometimes called Korea’s John Lennon. Joo, who left SM after his five-year contract expired, agrees. “Musically, we wanted to be seen as artists... not teeny-boppers doing bubblegum pop.” But he considers Lee Soo-Man a father figure: “SM knew exactly how to find an artist’s inner talent.”

While the pretty boys and girls of K-pop enjoy enormous popularity in Asia, that has not been replicated in Western markets. “K-pop can be a niche, but I don’t think it will break through in the West. They try too hard, they are too rigid,” says Daniel Tudor, author of Korea: The Impossible Country.

There are other complaints. “SM is very secretive at the top; they don’t talk much,” says Tudor. “Their business practices in the past have been questionable.” SM has been hit by a number of lawsuits and defections from artists over the years. Lee himself may be refocusing. Industry observers say the mogul, who is believed to own a California vineyard, is now as fascinated by wine as by music.

It is unclear whether SM will—or can—diversify into rock, rap and electronica. But it retains massive strengths. “The Korean market is hungry for non-K-pop forms of music,” says Russell. “SM has a very clear niche, and if they want to go be- yond that, it’s tricky, but I think they’ll do very well with what they have.”

Even Hahn acknowledges SM’s contributions. “I wish I’d had Lee Soo-Man when I was in my 20s and 30s! Before Lee it was, ‘Music is my life, I don’t care if I’m rich or poor.’ Now you can love music and be a millionaire!”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)